What’s New at EV CO

Are You Eligible for an EV Tax Credit?

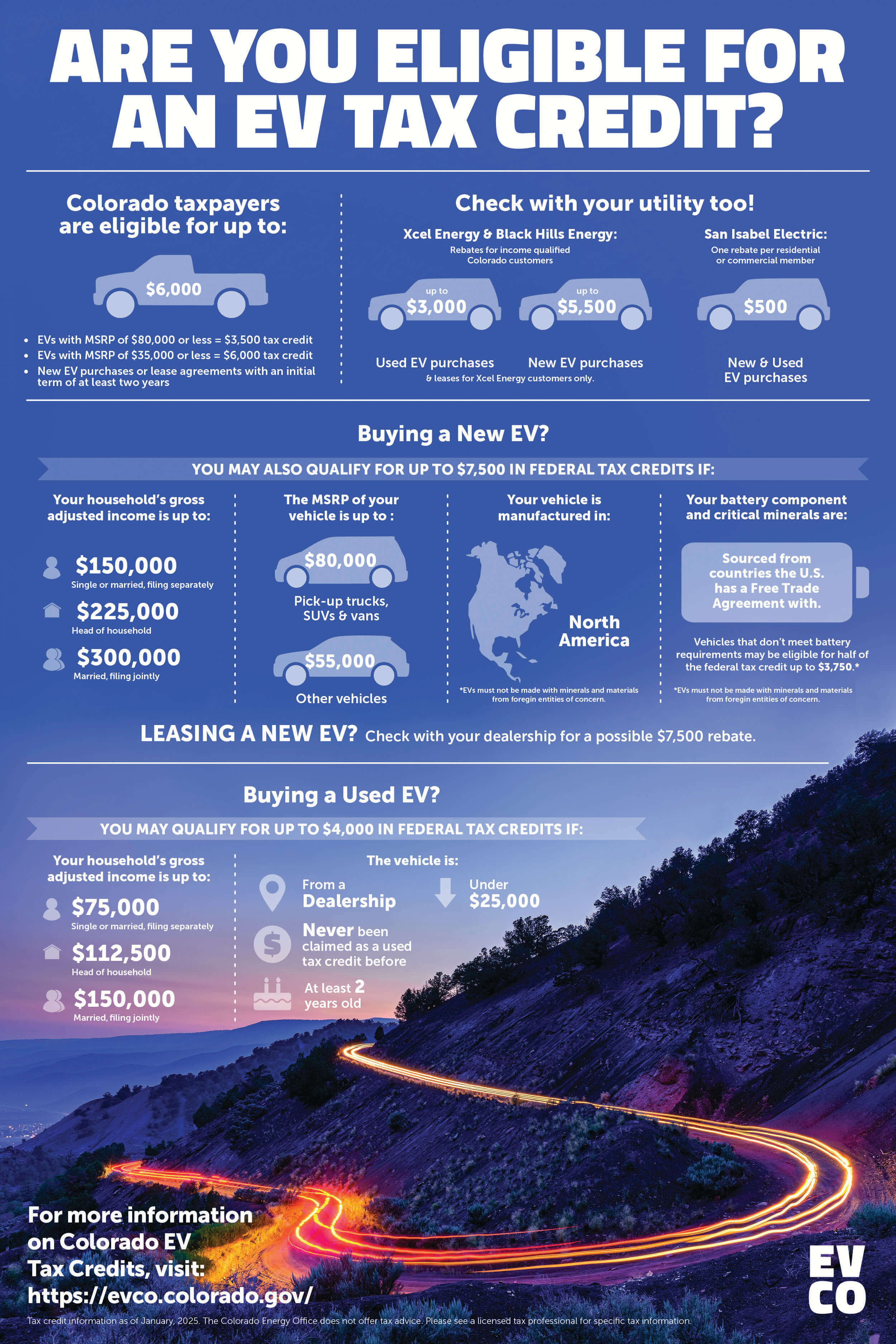

Are You Eligible for an EV Tax Credit?

There’s been a lot of buzz about electric vehicles and the tax credits that may help reduce what you’ll pay for your next EV. But what are EV tax credits and who can qualify for them?

What Are EV Tax Credits?

EV tax credits reduce the amount of income tax you owe to the state government. EV shoppers also have the option to assign their tax credit to a participating dealership, who will reduce the price of the vehicle by the tax credit amount.

Does Everyone Qualify for a Tax Credit?

If you pay taxes in Colorado, you’re eligible for a state tax credit of $3,500 with the purchase or lease of a new EV with an MSRP up to $80,000. Lease agreements must have an initial term of at least two years. EVs with an MSRP under $35,000 are also eligible for an additional tax credit of $2,500.

If you do not pay taxes in Colorado, you’ll need to check with the state where you do pay taxes to see what EV incentives are offered.

Used EVs are also eligible for a tax credit up to $4,000 or 30% of the purchase price and come with their own set of requirements as well.

- The state tax credit is now up to $6,000.

In Colorado, the $3,500 state EV tax credit for new EV purchases or leases will be paid whether you owe that much tax or not. New EV lease agreements must have an initial term of at least two years. EVs with an MSRP under $35,000 will be eligible for an additional tax credit of $2,500. - Claim up to $9,000!

The Vehicle Exchange Colorado (VXC) program offers even more savings, with rebates valued at up to $9,000 for new EVs and $6,000 for used EVs as of November 3, 2025. - $15,000

The total credit amount Coloradans could be eligible for when including the VXC program rebate.

EV Production Requirements

To qualify for the full federal EV tax credit amount, an EV must not be made with minerals and materials from foreign entities of concern. Furthermore, 50% of the critical mineral components used must be domestically produced or come from a country in which the US has a free trade agreement with, and 60% of the battery components must have final assembly in North America.

The U.S. Department of Energy has created a list of eligible vehicles to help you determine whether they qualify for part or all of the federal tax credit.

Check with your Utility Company for More Ways to Save

Some utilities in Colorado also offer rebates towards the purchase of an EV or towards an at-home charging station.

- San Isabel Electric Association Customers

San Isabel Electric Association customers may be eligible for a rebate of $500 with the purchase of an electric vehicle. Visit the SIEA website for more information. - Black Hills Energy Customers

Residential electricity customers who are income qualified may receive rebates of up to $3,000-$5,500 towards the purchase of a new or pre-owned EV. Visit the Black Hills Energy website for additional information.

Our infographic below simplifies your eligibility requirements to help you understand which tax credits or utility rebates you may be eligible for. To download our infographic in English or in Spanish, please visit our partner toolkit.

Want to Find More Ways to Save?

Visit our Save Money page to see other ways EVs can save you money, from cheaper fueling costs to reduced maintenance and even more utility-based rebates when you install at-home charging!

Ready to Make the Switch?

Now that you know about EV purchase incentives, let’s find the perfect EV for you. Check out this vehicle shopper tool, sponsored by Xcel Energy, where you can compare vehicle styles, prices and more! This tool is available to all, regardless of your utility company.